Tax Credits For Solar System Purchase

Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property.

Tax credits for solar system purchase. First enacted in 2005 as part of the energy policy act of 2005 the solar tax credit began as a tax credit of 30 percent of the cost to install a solar panel system with a maximum credit of 2 000. 0 3 18 000 1 000 5 1007 payment for renewable energy certificates. If you spend 10 000 on your system you owe 2 600 less in taxes the following year. If you re considering solar you ve probably heard about the federal solar tax credit also known as the investment tax credit itc the federal itc makes solar more affordable for homeowners and businesses by granting a dollar for dollar tax deduction equal to 26 of the total cost of a solar energy system.

5 minutes last updated on august 27 2020. Federal solar tax credit. If say your federal taxes are 6 000 for 2020 and you re eligible for a 7 000 tax credit for installing a solar system at your house you can claim the leftover 1 000 as a credit toward your. Filing requirements for solar credits.

Before you calculate your tax credit. All of the financial benefits listed below go to the owner of the solar panel system. In 2008 the itc was reauthorized and the cap was lifted. Renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems.

If you buy your system in cash or with a solar loan that means you also get the tax credits rebates and srecs for the system however if you lease your system the third party owner will receive all of the solar incentives. You calculate the credit on the form and then enter the result on your 1040. For example if your solar pv system was installed before december 31 2019 cost 18 000 and your utility gave you a one time rebate of 1 000 for installing the system your tax credit would be calculated as follows. The tax credits for residential renewable energy products are still available through december 31 2021.

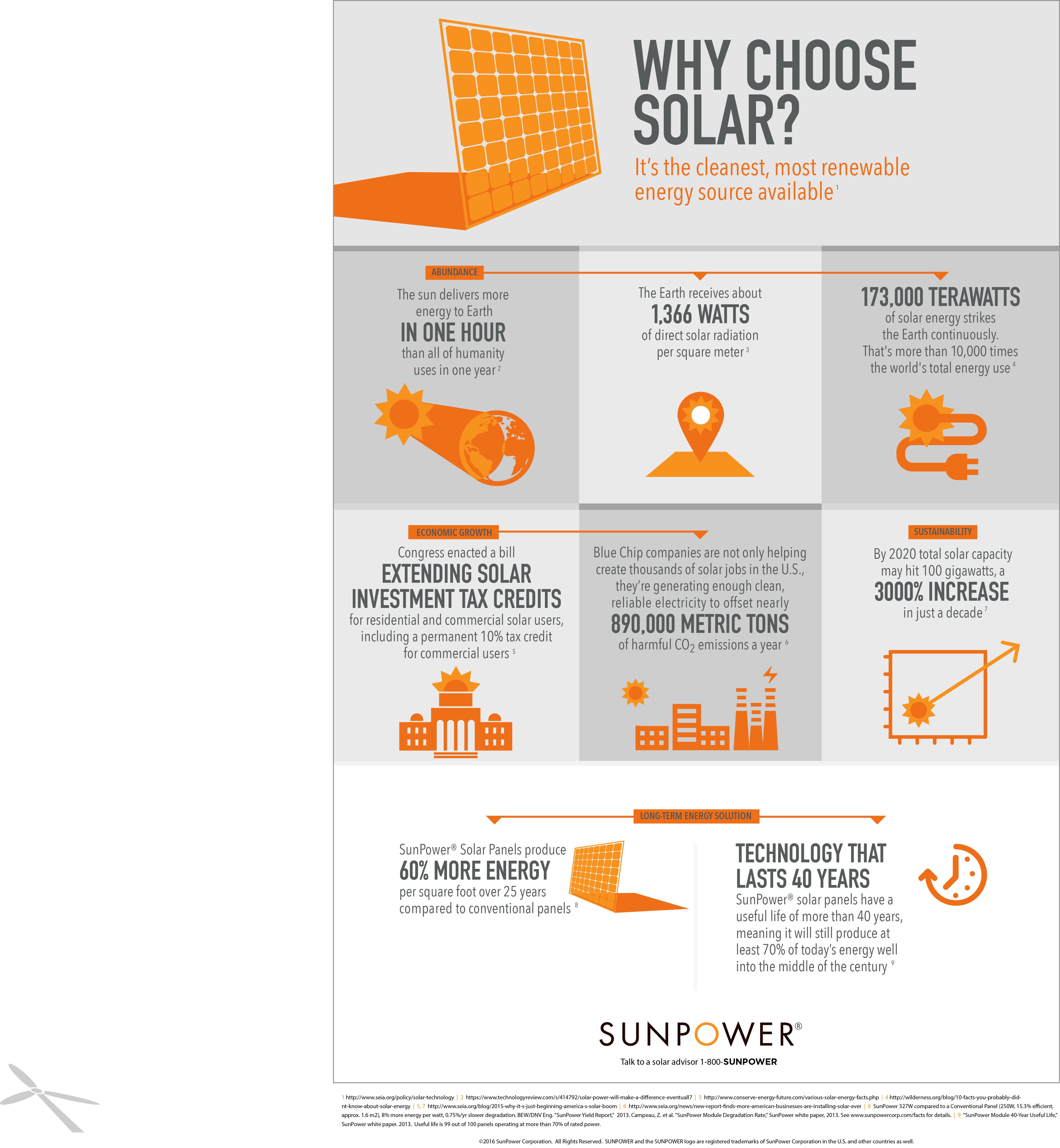

To claim the credit you must file irs form 5695 as part of your tax return. The solar tax credit expires in 2022. The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. The itc applies to both residential and commercial systems and there is no cap on its value.